1.8 billion in the account but not 60 million? The "iron rooster" who has not paid dividends for 20 years has exploded!

CCTV News:Since the beginning of this year, there have been explosions of companies in the A-share market, such as Buchang Pharmaceutical and Xincheng Holdings. The stock prices have been falling continuously, and investors have suffered heavy losses. In the past two days, dividends have also exploded. Dividends were originally a good thing, earning money to return investors, but this dividend was the first time I saw it.

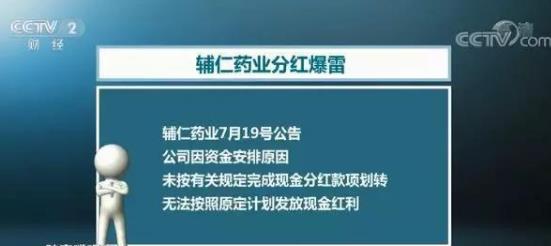

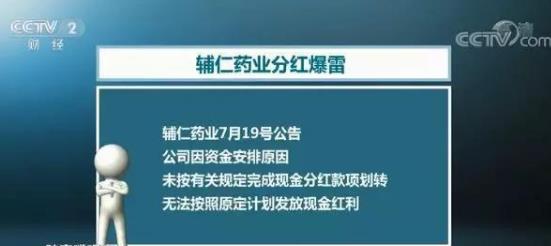

On the afternoon of July 19th, Fu Jen Pharmaceutical announced that due to funding arrangements, cash dividends could not be paid according to the original plan. According to the annual dividend plan of Furen Pharmaceutical in 2018, it is planned to distribute a total cash dividend of 62,715,800 yuan. The data shows that as of the end of the first quarter of 2019, the balance of monetary funds on Furen Pharmaceutical’s account was 1.816 billion yuan.

Some analysts in the industry believe that Fu Jen Pharmaceutical’s financial report data in recent years violates common sense and is suspected of serious fraud.

Furen Pharmaceutical has a thunder account of 1.8 billion but has no money to pay dividends.

Fu Jen Pharmaceutical announced on July 19th that due to financial arrangements, the company failed to complete the transfer of cash dividends in accordance with relevant regulations, and could not pay cash dividends as originally planned. The "iron rooster" who didn’t pay dividends for 20 years finally got a bonus last year. This year, it is clear that there are 1.8 billion monetary funds in the account in the first quarter, but even 60 million can’t be separated. I believe that after the resumption of trading, the stock price pressure will be great.

On July 15th, Dong ‘e Ejiao announced its semi-annual performance forecast, and its net profit decreased by 75% to 79% compared with the same period of last year. On July 12th, Han’s laser forecast net profit decreased by 60%-65% year-on-year. The market was shocked, and Baima would step on thunder, and its share price plummeted.

Another example is the former Xincheng Holdings and Buchang Pharmaceutical. Because the scandal of the company’s chairman was exposed, the stock price fell.

There are also people who are particularly concerned about Kangmei Pharmaceutical and Kangdexin. Because of their alleged financial fraud, their share prices have fallen by only a fraction. In addition, in the past two years, Shapu Aisi and Erkang Pharmaceutical, various emergencies have caused listed companies to explode.

The proportion of R&D in explosive pharmaceutical enterprises is low, and the sales expenses are high.

Further observation of so many companies that explode mines, among which pharmaceutical companies account for a lot. Simply analyzing these companies, Furen Pharmaceutical spent 230 million yuan on R&D and 820 million yuan on sales in 2018, accounting for 3.6% and 13.0% of revenue respectively.

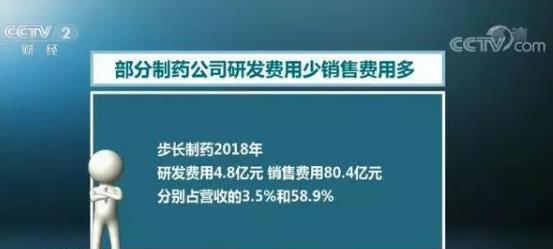

In 2018, Buchang Pharmaceutical spent 480 million yuan on R&D and 8.04 billion yuan on sales, accounting for 3.5% and 58.9% of revenue respectively.

Generally speaking, the R&D expenses of these companies are relatively low, but on the other hand, the sales expenses are relatively high, such as Buchang Pharmaceutical. Nearly 60% of the operating income is used for sales, and I don’t know where the money has gone. Many investors believe that if products are not competitive, they can only strengthen sales and even play the edge ball.

Pharmaceutical companies generally have a high gross profit margin, but apart from the relevant employees, in fact, many people simply don’t understand the company, and they can’t know the actual curative effect of the products, and how the actual sales are. For example, some Chinese medicine companies have unclear curative effects due to historical reasons. Recently, many Chinese medicine injections have been restricted, and related listed companies will be affected.

Lujiazui view:

For investors, if they see pharmaceutical companies with low R&D expenses and high sales expenses, they should be careful to avoid stepping on thunder.